An adjustable-rate mortgage commonly referred to as an arm loan is a loan that’s interest rates and payments can vary from year to year or month to month. An arm loan will have a period of time with a fixed interest rate and then for the remaining life of the mortgage, the interest rate will vary. Both FHA and conventional mortgages can be arm loans.

How Does An Arm Loan Work

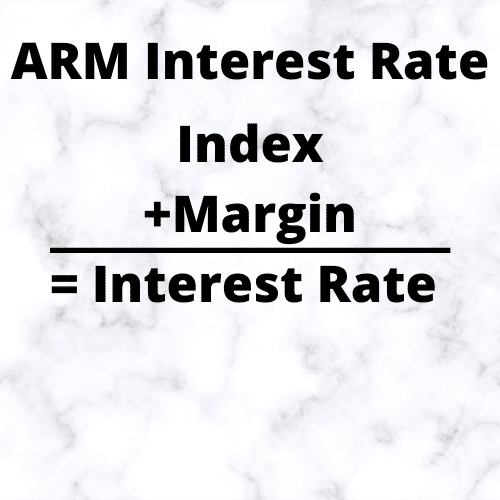

An arm loan is made up of two main parts the index and the margin. Both of these combined make the interest rate. The index is a reference rate bank can use to determine the current market rate. The most common indexes are the maturity yield on one-year Treasury bills, the 11th District cost of funds index, or the London Interbank Offered Rate. To see today’s rates check out HSH. While the index can change yearly the margin on an arm loan will always stay the same for the life of the loan. The margin is the margin the lender accepts for taking the risk of the loan. For example, if the current index is 2% and the margin is 2% then your interest rate would be 4%. Next year the index drops to 1% but the margin stays the same at 2% making your interest rate 3%. Arms also have a cap on how much they can increase on your loan so if the index jumps high your interest rate won’t.

7/1 And 5/1 Arm Loans

7/1 and 5/1 are very conman arm loan terms. For the 7/1 the interest rate is locked for the first 7 years of the loan and after that, it goes to the index rate. The 1 means that the rate can change annually. The same thing with the 5/1 arm loan. For the first 5 years, the loan is at a fixed rate and after five years the loan can be adjusted annually depending on the rates and the caps.

Adjustable-Rate Mortgage Pros And Cons

Adjustable Rate Mortgage Pros

- Interest rates can decrease with the index

- Low-interest rates during the fixed period

- Flexibility

- Slight protection with caps

- Can be cheaper to get than tradional options

Adjustable Rate Mortgage Cons

- Interest rates can increase with index

- Future yearly or monthly payments are unknown

- Hard to plan ahead for

- Can become more expensive than fixed-rate

Is An Arm Loan A Bad Idea?

As of writing this in mid-2020, an adjustable-rate mortgage is not a good idea. The main reason is interest rates are at the lowest they have been for a while so getting a fixed-rate mortgage at a lower rate today is better than any adjustable rate in the future. The other reason is market uncertainty and individual finical uncertainty. With the rising unemployment and market uncertainty of 2020 having the adjustable-rate mortgage can hurt you later when you are not sure what next year’s payments might be.