Did you know 1 out of 5 houses in Florida are in a special flood zone. Let’s say you have been working hard looking at all the houses in an area and you finally find the perfect one. Amazing front, beautiful paint, huge backyard everything you could ever want but shortly after putting in an offer the real estate agent tells you the house is in flood zone v. What does that mean? Is this going to cost you more money?

Here in Boca Raton flooding is a constant issue since we live so close to the beach and can get hit hard with hurricane rains. In this article, I will go over the different types of flood zones and how they can impact your home buying process. Along with some pros and cons of buying in a flood zone.

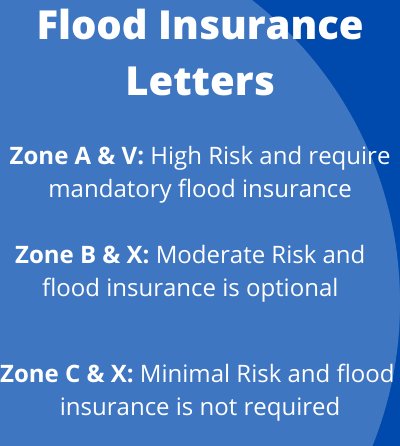

Flood Zone Letter Codes

There are different codes to distinguish the risk of flooding in the area. If you look at a list it goes on and on with a bunch of different letter combinations but here is the easy break down to understand what letters mean what. Looking at the first letter of the letter combination should tell you imminently if you are ina high risk, moderate, or minimal risk area.

Being in the high-risk zone requires you to have flood insurance with your mortgage since there is a 1-percent annual chance of flooding. Moderate risk areas have a 0.2-percent-annual-chance of flooding. Minimal risk areas are like moderate risk areas but are higher in elevation. To know which zone a house is in you can contact the zoning department of a city or go online to the FEMA website.

Pros and Cons Of Buying In A Flood Zone

Pros:

-Houses in flood zones tend to be closer to water.

-Negotiation leverage

-House might be cheaper

Cons:

-Risk of house getting flooded and having flood damage.

-Monthly flood insurance

It is important to note that flood zones change every year and just because your house is not in a flood zone means there are zero risks. A perfect example is when hurricane Harvey hit Houston and a lot of houses that were not in flood zones getting damaged with many homeowners not having flood insurance.

Flood Insurance And Mortgages

If you looking to buy a house in a flood zone A or V, aka the high-risk areas, and are trying to get a mortgage with Fannie Mae, Freddie Mac, FHA, USDA, or VA loan, basically any government-related lender, you are required to get flood insurance. The most conman program is The National Flood Insurance Program (NFIP) which was made by FEMA. This cost around $708 a year. You can go private but those rates vary and the policy has to be approved by the lender you are trying to get the mortgage with.

Buying In A Flood Zone

Before committing to buying the house take some time and speak with the current owner, real estate agent, or any friends and family you might have that live in a flood zone.

Speak with the homeowner and see how long they have been living there, what insurance do they have, and what storms or events cause any damage if any. Speak to your real estate agent they see so many houses per day that they have almost seen it all. They should be able to tell you based on location what risks are present and how often it might flood based on the bodies of water nearby. Lastly speaking with friends and families who live in flood zones to get their opinions if they think it’s a big risk or if they do not mind living in that area.