Your Path to Homeownership

With Florida FHA Loans

Unlock Affordable FHA Home Financing

Understanding FHA Loans In Florida

FHA loans are a popular choice for many homebuyers, offering flexibility and affordability. These loans are insured by the Federal Housing Administration (FHA), meaning the government backs them. This insurance protects lenders, making them more willing to offer favorable terms to borrowers. Whether you’re a first-time homebuyer, looking to refinance, or seeking a more flexible lending option, an FHA loan can be an excellent choice.

Benefits of FHA Loans

Lower Down Payment Requirements: One of the most attractive features of an FHA loan is the low down payment requirement. Borrowers can qualify with a down payment as low as 3.5% of the purchase price. This is significantly lower than the typical 20% required for conventional loans, making homeownership more accessible to many first-time buyers and those with limited savings.

Flexible Credit Score Criteria: FHA loans are known for their lenient credit score requirements. While conventional loans typically require higher credit scores, FHA loans allow borrowers with scores as low as 580 to qualify for the 3.5% down payment option. Even those with lower scores may still be eligible with a larger down payment. This flexibility opens the door for individuals with less-than-perfect credit histories to achieve their homeownership goals.

Competitive FHA Interest Rates: FHA loans interest rates are often more competitive interest rates, which can result in lower monthly mortgage payments compared to some conventional loans. This can make a significant difference over the life of the loan, saving you money and helping you manage your budget more effectively.

Easier Qualification for Refinancing: FHA loans also offer a streamlined refinancing process through the FHA Streamline Refinance program. This program allows existing FHA borrowers to refinance with minimal documentation and without a new appraisal, making it easier to take advantage of lower interest rates and reduce monthly payments.

See If You Qualify

Why Choose MJS Financial for FHA Loans?

Welcome to MJS Financial LLC, your trusted mortgage broker in South Florida. We specialize in providing personalized mortgage solutions, including Florida FHA loans, to help you achieve your homeownership dreams. Our team of experts is dedicated to guiding you through every step of the mortgage process, ensuring you find the best loan options tailored to your unique needs. Whether you’re a first-time homebuyer or looking to refinance, MJS Financial is here to help you navigate the complexities of FHA loans in Boca Raton and across Florida.

EXCELLENTTrustindex verifies that the original source of the review is Google. Our office just closed on a purchase with Ben! My office was the title company for the closing. Ben is very efficient and a good communicator, which is essential to a successful closing. Often times we wait for the broker to get back with us and keep us in the loop. Ben always answers the phone and gets the info you need quickly so we can keep the closing moving. The closing went smooth, and the buyers were extremely happy Ben :)Posted onTrustindex verifies that the original source of the review is Google. Benjamin was professional and communicative. He made the home buying process a smooth and quick one. Highly recommended!Posted onTrustindex verifies that the original source of the review is Google. MJS Financial and Benjamin made the closing process very easy and seamless. As I work for a title company, sometimes the broker's can make our job harder but Benjamin was very helpful and insightful and made my job easier. I wish all our transactions were with Benjamin.Posted onTrustindex verifies that the original source of the review is Google. An easy 5 stars, I’d put more if I could. MJS made the process of securing a mortgage so seamless. They exhibited the utmost in professionalism and kindness. Highly recommended!Posted onTrustindex verifies that the original source of the review is Google. Amazing brokerage! Ben worked quickly and efficiently. He always had what was best for me as his priority.Posted onTrustindex verifies that the original source of the review is Google. Martin and Ben are always prompt and informative. I highly reccomend working with them for your mortgage needs.Posted onTrustindex verifies that the original source of the review is Google. Knowledgeable, proactive and very responsive. It was a pleasure working with Ben to get the loan closed.Posted onTrustindex verifies that the original source of the review is Google. I couldn't have found better mortgage brokers to work with than Martin and Ben. They walked me through every step of the mortgage process with great professionalism and knowledge. I was completely new to the process so I was really appreciative of their responsiveness to my emails and phone calls as well as prompt and thorough replies to all of my questions. They are a terrific team that skillfully navigated me through a long and sometimes complicated process. Would recommend their services in a heartbeat.Posted onTrustindex verifies that the original source of the review is Google. Martin and Ben were extremely helpful and a pleasure to work with.Posted onTrustindex verifies that the original source of the review is Google. Made the process as smooth and efficient as possible. Very responsive and accessible throughout, which was greatly appreciated. Excellent service.

FHA Loan Requirements in Florida

To qualify for an FHA loan in Florida, there are several key requirements that potential borrowers must meet. These requirements are designed to ensure that applicants are financially capable of managing a mortgage while also providing flexibility to make homeownership accessible. Here’s a detailed look at the primary FHA loan requirements:

- Credit Score: Minimum of 580 for a 3.5% down payment; 500-579 requires a 10% down payment.

- Down Payment: As low as 3.5% for credit scores 580 and above. Down payments can come from savings, gifts, or assistance programs.

- Employment and Income: Steady employment history for at least two years. The debt-to-income ratio should generally be 43% or lower.

- Property Standards: Must meet FHA safety, habitability, and structural integrity standards. Must be the borrower’s primary residence.

- Mortgage Insurance: Requires upfront mortgage insurance premium (UFMIP) and annual mortgage insurance premium (MIP).

- Debt-to-Income Ratio: Front-end DTI should be no more than 31%, back-end DTI no more than 43%.

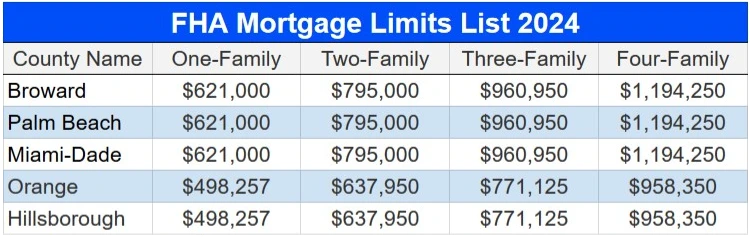

- Loan Limits: Vary by county and are updated annually. Check current limits in your area.

- Residency: Available to U.S. citizens, permanent residents, and eligible non-permanent residents. Must occupy the property as the primary residence.

- Documentation: Includes recent pay stubs, W-2 forms, tax returns, bank statements, and proof of funds for down payment and closing costs.

FHA Closing Costs and FHA Loan Limits

When considering an FHA loan in Florida, it’s important to understand the associated closing costs and loan limits. Closing costs typically include fees for appraisal, credit report, title insurance, and other services, ranging from 2% to 5% of the loan amount. In Florida, FHA loan limits vary by county and are adjusted annually. For example, the FHA limit in Broward County for 2024 is expected to be higher due to the area’s property values. At MJS Financial, we provide detailed information on these costs and limits to help you budget effectively for your home purchase. Check out the mortgage calculator to see what payments could look like.

- Appraisal Fees: Required to determine the market value of the property.

- Credit Report Fees: Charges for pulling your credit report.

- Title Insurance: Protects against potential legal issues with property ownership.

- Origination Fees: Charges for processing the loan application.

- Attorney Fees: If legal services are required during the transaction.

- Inspection Fees: Costs for home inspections to ensure the property meets FHA standards.

- Recording Fees: Charges for recording the mortgage with the local government.

- Other Services: This can include courier fees, pest inspection, and other miscellaneous costs.

Typically, closing costs can range from 2% to 5% of the loan amount. For example, on a $300,000 loan, closing costs might range from $6,000 to $15,000. It’s important to budget for these costs in advance to avoid any surprises at closing. Additionally, some of these costs can be financed into the loan or covered by the seller or lender, which can ease the financial burden.

Florida FHA Loan Limits

FHA loan limits vary by county and are based on local housing market conditions. These limits are adjusted annually to reflect changes in home prices. In Florida, different counties have different limits. For example:

- Broward County: Due to its higher property values, the FHA loan limit for 2024 is expected to be higher. This allows borrowers in Broward County to finance more expensive homes with an FHA loan.

- Palm Beach County: Similar to Broward, Palm Beach also has higher limits compared to less expensive counties.

- Miami-Dade County: Often has limits comparable to Broward and Palm Beach due to similar property market conditions.

- Other Counties: In more rural or less expensive counties, the limits may be lower, reflecting the local housing prices.

It’s essential to check the current FHA loan limits for the county where you plan to buy a home. At MJS Financial, we provide up-to-date information on these limits to help you understand how much you can borrow and plan your home purchase accordingly.

Florida FHA Loans FAQ

While the lending environment can fluctuate, FHA loans remain accessible due to their flexible qualification criteria. Even with changes in the market, FHA loans are designed to help borrowers with lower credit scores and smaller down payments. At MJS Financial, we can help you understand the current requirements and improve your chances of approval.

FHA loan limits in Florida vary by county and are adjusted annually to reflect changes in home prices. For 2024, the limits will differ depending on where you are buying. For example, higher-cost areas like Broward County have higher limits. Contact MJS Financial for the most up-to-date information on FHA loan limits in your specific area.

Closing costs for an FHA loan in Florida typically range from 2% to 5% of the loan amount. These costs include appraisal fees, credit report fees, title insurance, and more. At MJS Financial, we provide a detailed estimate of your closing costs to help you budget effectively.

To qualify for an FHA loan in Florida, you need a minimum credit score of 580 for a 3.5% down payment. Other requirements include a steady employment history, a reasonable debt-to-income ratio, and meeting property standards set by the FHA. Our team at MJS Financial will guide you through each requirement to ensure you meet all criteria.

Yes, FHA loans are an excellent option for first-time homebuyers due to their low down payment requirements and flexible credit score criteria. They also offer competitive interest rates and the ability to finance closing costs. MJS Financial specializes in helping first-time buyers navigate the FHA loan process.

Absolutely! FHA loans can be used to purchase properties in Boca Raton and throughout Florida. These loans are ideal for buyers looking to purchase a home in a desirable area like Boca Raton. Our team at MJS Financial is experienced in securing FHA loans for clients in this region.

The FHA generally prefers a front-end DTI ratio of no more than 31% and a back-end DTI ratio of no more than 43%. However, higher ratios might be accepted with compensating factors such as a higher credit score or significant savings. MJS Financial can help you calculate your DTI ratio and explore your options.

The timeline for FHA loan approval can vary, but it typically takes about 30 to 60 days from application to closing. This includes the time needed for document submission, appraisal, underwriting, and final approval. MJS Financial strives to streamline the process and keep you informed at every step.

How to Apply for an FHA Loan

Applying for an FHA loan with MJS Financial is a straightforward process. Here’s a step-by-step guide to help you understand the layout and what to expect at each stage:

Gather Essential Documents:

- Tax Returns: Two most recent years (both personal and business, if applicable).

- Bank Statements: Last two months of statements to verify funds and transactions.

- Proof of Employment: Recent pay stubs or other documentation to verify steady income.

- Identification: A copy of your driver’s license or other valid ID.

Initial Consultation:

- Meet with a Mortgage Specialist: Schedule a consultation with one of our mortgage specialists to discuss your financial situation and homeownership goals.

- Pre-Approval Application: We’ll help you complete the loan application, which includes providing the gathered documents and filling out necessary forms.

Pre-Approval Process:

- Credit Check: We’ll perform a credit check to assess your eligibility for an FHA loan.

- Review of Financials: Our team will review your financial documents to determine your loan amount and eligibility.

- Pre-Approval Letter: If you meet the requirements, we’ll issue a pre-approval letter indicating how much you can borrow.

House Hunting:

- Start Shopping: With your pre-approval letter in hand, you can begin searching for your dream home in Boca Raton or anywhere in Florida.

- Work with a Real Estate Agent: Partner with a trusted real estate agent to find properties that meet your criteria and fit within your pre-approved budget.

Make an Offer:

- Submit an Offer: Once you find the right property, work with your agent to submit an offer to the seller.

- Offer Acceptance: If the seller accepts your offer, the process moves to the next stage.

Home Appraisal:

- Appraisal Order: We’ll order an FHA-approved appraisal to determine the market value of the property and ensure it meets FHA standards.

- Appraisal Review: Review the appraisal report to confirm the property’s value and condition.

Finalizing the Loan:

- Underwriting: Our underwriting team will review all documentation, including the appraisal report, to finalize loan approval.

- Condition Clearance: Address any conditions or additional documentation requests from the underwriter.

Closing the Loan:

- Schedule Closing: Coordinate a closing date with the seller, real estate agents, and title company.

- Review Closing Disclosure: Receive and review the Closing Disclosure document, which outlines the final terms and costs of the loan.

- Sign Closing Documents: Attend the closing meeting to sign all necessary documents and finalize the purchase.

Post-Closing:

- Receive Keys: Once the closing is complete, you’ll receive the keys to your new home.

- Move In: Congratulations! You can now move into your new home and start the next chapter of your life.

Disclaimer: The information provided on this page is for general informational purposes only and does not constitute financial, legal, or professional advice. MJS Financial LLC makes no guarantees regarding the accuracy or completeness of the information provided and is not responsible for any errors or omissions. Loan terms, conditions, and eligibility requirements are subject to change without notice. Prospective borrowers should consult with a licensed mortgage professional to understand their specific financial situation and to obtain personalized advice. MJS Financial LLC is an equal housing lender.