Florida Home

Loans Made Easy

Your South Florida Mortgage Broker With

Great Service and Competitive Rates

Welcome to MJS Financial LLC – Your Premier South Florida Mortgage Broker located in Boca Raton!

With over 15 years of dedicated service in the Sunshine State, we pride ourselves on empowering homeowners and buyers throughout South Florida, especially in the vibrant community of Boca Raton. At MJS Financial LLC, it’s not just about securing a mortgage or home loan; it’s about tailoring solutions that truly fit your life. Our deep-rooted knowledge of the local market and our commitment to personalized service ensure you receive the best mortgage options available.

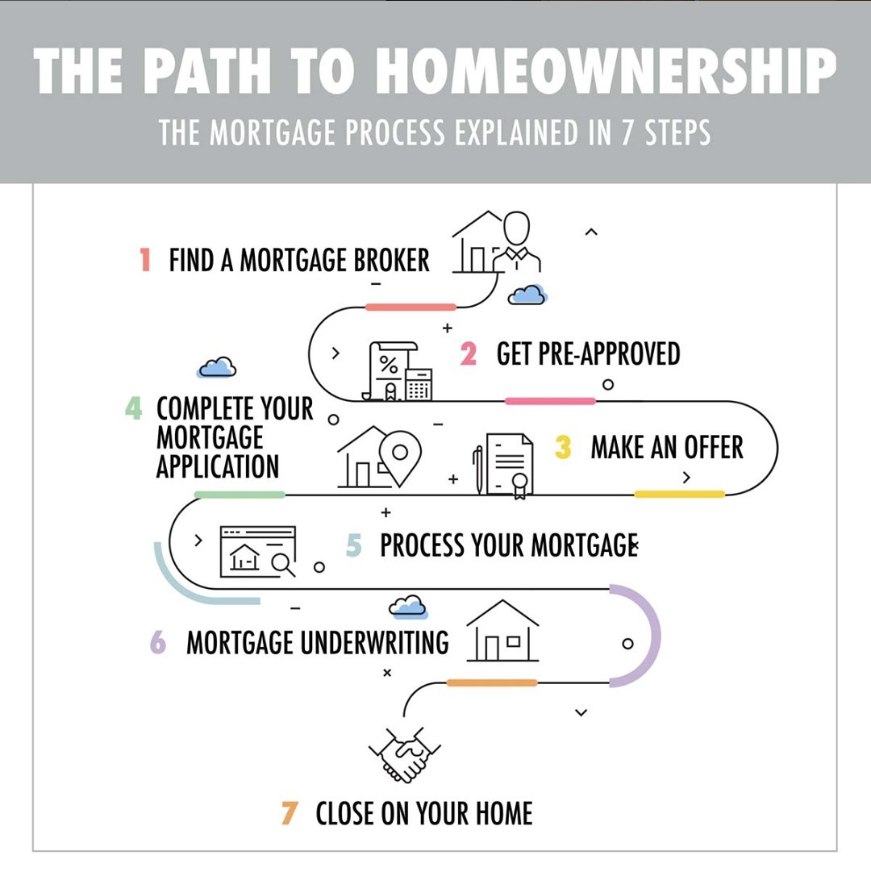

Whether you’re buying your first home loan, refinancing, or seeking an investment property, our team is here to guide you every step of the way. Experience a seamless mortgage process designed with you in mind. Call or click today to start your journey with a partner you can trust. Your dream home awaits!

EXCELLENTTrustindex verifies that the original source of the review is Google. Our office just closed on a purchase with Ben! My office was the title company for the closing. Ben is very efficient and a good communicator, which is essential to a successful closing. Often times we wait for the broker to get back with us and keep us in the loop. Ben always answers the phone and gets the info you need quickly so we can keep the closing moving. The closing went smooth, and the buyers were extremely happy Ben :)Trustindex verifies that the original source of the review is Google. Benjamin was professional and communicative. He made the home buying process a smooth and quick one. Highly recommended!Trustindex verifies that the original source of the review is Google. MJS Financial and Benjamin made the closing process very easy and seamless. As I work for a title company, sometimes the broker's can make our job harder but Benjamin was very helpful and insightful and made my job easier. I wish all our transactions were with Benjamin.Trustindex verifies that the original source of the review is Google. An easy 5 stars, I’d put more if I could. MJS made the process of securing a mortgage so seamless. They exhibited the utmost in professionalism and kindness. Highly recommended!Trustindex verifies that the original source of the review is Google. Amazing brokerage! Ben worked quickly and efficiently. He always had what was best for me as his priority.Trustindex verifies that the original source of the review is Google. Martin and Ben are always prompt and informative. I highly reccomend working with them for your mortgage needs.Trustindex verifies that the original source of the review is Google. Knowledgeable, proactive and very responsive. It was a pleasure working with Ben to get the loan closed.Trustindex verifies that the original source of the review is Google. I couldn't have found better mortgage brokers to work with than Martin and Ben. They walked me through every step of the mortgage process with great professionalism and knowledge. I was completely new to the process so I was really appreciative of their responsiveness to my emails and phone calls as well as prompt and thorough replies to all of my questions. They are a terrific team that skillfully navigated me through a long and sometimes complicated process. Would recommend their services in a heartbeat.Trustindex verifies that the original source of the review is Google. Martin and Ben were extremely helpful and a pleasure to work with.Trustindex verifies that the original source of the review is Google. Made the process as smooth and efficient as possible. Very responsive and accessible throughout, which was greatly appreciated. Excellent service.

All Loan Types:

At MJS Financial LLC, we understand that every borrower has unique needs and financial situations. That’s why we offer diverse loan options to help you find the perfect fit for your home financing goals. Whether you’re a first-time homebuyer, a veteran, or looking to invest in real estate, our team is here to guide you through the process and secure the best loan for your needs. We hope to become your go-to mortgage broker in Boca Raton and all of Florida.

- Conventional

- FHA

- Jumbo

- VA

- HELOC

- DSCR

- Bank Statements

- Reverse

Mortgage FAQ

Improving your chances of approval involves maintaining a strong credit score, saving for a down payment, and reducing your debt-to-income ratio. MJS Financial can help you understand where you stand and offer tips for improving your eligibility.

A fixed-rate mortgage maintains the same interest rate throughout the loan term, while an adjustable-rate mortgage (ARM) starts with a lower rate that can change over time. We can help you weigh the pros and cons based on your situation.

You’ll typically need proof of income, employment verification, credit history, and information about your debts and assets. At MJS Financial, we provide a detailed list to ensure a smooth process.

A South Florida Mortgage Broker, like MJS Financial, offers personalized service, access to multiple lenders, and local market expertise, providing a tailored and often more cost-effective mortgage solution.

Yes, self-employed individuals can qualify for mortgages, although the documentation requirements may differ. We specialize in helping self-employed clients secure favorable terms for their Florida home loans.

Private Mortgage Insurance (PMI) is required if you put down less than 20% of your home’s value. We can discuss options for avoiding or reducing PMI when you work with us for your mortgage needs.

The most home loan mortgage terms are 15 and 30 years, though other options are available. We can help you decide which term aligns best with your financial goals.

A Home Equity Line of Credit (HELOC) is a home loan product that allows you to borrow against your home’s equity, functioning similarly to a credit card. It’s a flexible option for accessing funds, and we can help you determine if it’s the right choice for you.

The amount you can afford depends on your income, debt, and down payment. We offer pre-approval services to help you understand your budget before you start house hunting for a Florida home loan. Another benefit of working with a South Florida Mortgage Broker for your Florida home loan. Florida FHA loans are popular first-time home buyer loans.

Yes, you can lock in an interest rate for a set period during the mortgage process to protect against rate increases. We offer guidance on timing your rate lock for the best advantage.